ads/wkwkland.txt

15 Top Pictures Cash App Limit Atm : Cash App Card Atm How To Use Limit And Withdraw Cash 2020. Additionally, the platform may ask you to provide more information if it's. Fidelity cash management account customers or fidelity accounts coded premium, private client group, or wealth management, or held by customers with householded annual trading activity of 120 or more stock, bond, or options trades, will be reimbursed for atm fees charged by other institutions. Transactions, fees & accessibility getting cash at an atm making deposits at an atm making transfers and credit card payments at an atm customizing your atm experience getting email receipts at an atm using contactless atms troubleshooting atm issues using atms in foreign. Daily limit for atm cash withdrawal. Atm cash withdrawal limits generally range from $500 to $3,000 depending on the bank and account type, while daily purchase limits can range from using the bank app or online account.

ads/bitcoin1.txt

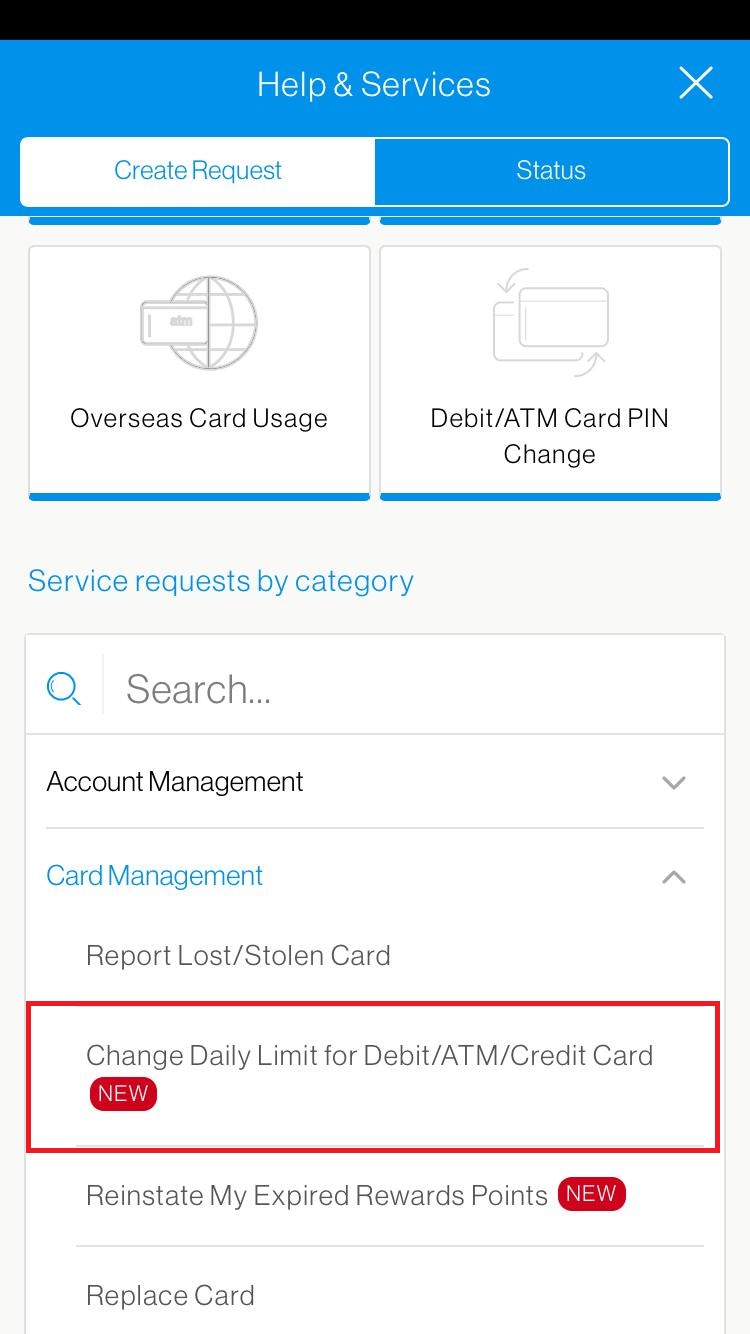

If you need more physical cash or daily funds available, there are a few ways to raise your atm withdrawal and daily debit limits. You will change axis bank debit card limit change. The more information you give, the more services you unlock with gcash. Fidelity cash management account customers or fidelity accounts coded premium, private client group, or wealth management, or held by customers with householded annual trading activity of 120 or more stock, bond, or options trades, will be reimbursed for atm fees charged by other institutions. Your best bet is to avoid fees by not using the atm and checking your balance or otherwise managing the card using netspend's mobile app.

Cash in from agent and receive from a bkash account holder can withdraw a maximum amount of tk 25,000 per day and tk 150,000 per month from his/her account (agent & atm combined).

ads/bitcoin2.txt

Get cash from any international atm and purchase at any international card machine with the mastercard® logo. You may also want to see if you're eligible for an account that automatically offers higher purchase and atm cash. Enter the amount you want to send. Check whether the atm accepts deposits, stack your bills and checks, follow the prompts to insert, then verify your total. The platform requires you to provide your personal information, including your full name, date of birth, and the last four digits of your social security number. The more information you give, the more services you unlock with gcash. Additionally, the platform may ask you to provide more information if it's. Plus, you can load up to $7,500 in cash in a day. Ever wonder why maximum atm withdrawal limits exist?the reason is that it is not uncommon for crooks to target atm users who have just taken out cash. Some debit cards allow you to manage your withdrawal limit in the barclays app1. Transactions, fees & accessibility getting cash at an atm making deposits at an atm making transfers and credit card payments at an atm customizing your atm experience getting email receipts at an atm using contactless atms troubleshooting atm issues using atms in foreign. Cash app has a transfer limit for how much you can send and how much you can receive. Open your cash app mobile app on the device.

How much you can withdraw depends on three things: You may also want to see if you're eligible for an account that automatically offers higher purchase and atm cash. Our customer support is here to help. You are not able to check your balance at the atm at this time. You will change axis bank debit card limit change.

How to increase or decrease axis debit card international limit.

ads/bitcoin2.txt

We gathered this information by viewing each bank's account disclosures online and contacting customer service representatives. Additionally, if you have a cash app debit card, you can use atms to withdraw up to $250 at a time; After you have inserted the card, use the pin to withdraw money. Our express cash and cash advance programs allow you the convenience of using your card, along with a designated pin (personal identification number) to withdraw cash at participating atm locations worldwide. Fidelity cash management account customers or fidelity accounts coded premium, private client group, or wealth management, or held by customers with householded annual trading activity of 120 or more stock, bond, or options trades, will be reimbursed for atm fees charged by other institutions. Learn about fees and concerns in our review. Some debit cards allow you to manage your withdrawal limit in the barclays app1. Since it's obvious that cash app doesn't work from many countries outside of the us and uk, vpn is used to route our ip to a foreign ip. Cash in limits include any transfer received from bank, cash in from agent & cash in from mastercard. Get cash from any international atm and purchase at any international card machine with the mastercard® logo. You are not able to check your balance at the atm at this time. Debit card cash advances at branches still have limits, but they're generally higher than limits at your local atm. Additionally, the platform may ask you to provide more information if it's.

However, there is a $2.50 fee every time you make a withdrawal from an atm outside the moneypass and vpa networks. Learn about fees and concerns in our review. Doing this allows you to log into the cash app platform and register successfully, but you'd experience limitations because your account isn't verified. All cash app transactions must take place between users based in the same country. Cash app has a transfer limit for how much you can send and how much you can receive.

You may also want to see if you're eligible for an account that automatically offers higher purchase and atm cash.

ads/bitcoin2.txt

Cash app has a transfer limit for how much you can send and how much you can receive. You are not able to check your balance at the atm at this time. After you have inserted the card, use the pin to withdraw money. $1,000 per cash app users who would like to use their cash card to make withdrawals at an atm can only withdraw a maximum of $250 per atm per day or. The more information you give, the more services you unlock with gcash. Cash app use at an atm? Ever wonder why maximum atm withdrawal limits exist?the reason is that it is not uncommon for crooks to target atm users who have just taken out cash. Your best bet is to avoid fees by not using the atm and checking your balance or otherwise managing the card using netspend's mobile app. By getting verified, you provide more information which validates your identity. 1% of withdrawal amount all fees and charges mentioned above are exclusive of taxes. Start by confirming whether you can deposit money in a particular atm; Your atm withdrawal and daily debt purchase limit will typically vary from $300 to $2,500 depending on who you bank with and what kind of account you have. Open your cash app mobile app on the device.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt

ads/wkwkland.txt

0 Response to "15 Top Pictures Cash App Limit Atm : Cash App Card Atm How To Use Limit And Withdraw Cash 2020"

Posting Komentar